The Federal Treasurer, Dr Jim Chalmers, handed down the 2024–25 Federal Budget at 7:30 pm (AEST) on 14 May 2024.

Described as a “responsible Budget that helps people under pressure today”, the Treasurer has forecast a second consecutive surplus of $9.3 billion. The main priorities of the Government, as reflected in the Budget, are helping with the cost of living, building more housing, investing in skills and education, strengthening Medicare and responsible economic management to help fight inflation.

Compared to recent years, tax measures do not form a large part of this year’s Budget. Besides the already legislated personal tax cuts – which will apply from 1 July 2024 and are included in this Budget’s estimates – the Government has used the tax system to incentivise investment in certain areas (hydrogen production and critical minerals) under its Future Made in Australia policy. Small businesses continue to receive support through an additional year of the instant asset write-off for depreciating assets and tax changes were also announced affecting multinationals.

The Government anticipates that the tax measures put forward will collectively improve the Budget position by $3.1 billion over a 5-year period to 2027–28.

The Government has presented measures which are designed to reduce inflation to less than 3% by 31 December 2024. The success of this Budget will be measured via the CPI index over the next six to twelve months and how the Reserve Bank will react to economic conditions in setting its monetary policy, including interest rates.

The tax, superannuation and social security budget highlights are set out below. For our full Budget analysis please refer to our detailed report found via this link:

![]() 2024/2025 Full Detailed Federal Budget Report

2024/2025 Full Detailed Federal Budget Report

Individuals

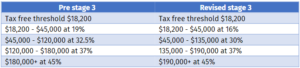

- Tax relief offered through revised tax brackets and Medicare Levy threshold increases. The revised Stage 3 tax cut changes will take effect from 1 July 2024 and are summarised in the table below:

- There will be increases to the Medicare levy low-income thresholds and surcharge low-income thresholds for the 2023-24 and later income years.

- The list of deductible gift recipients will be updated.

- All households will receive a $300 energy rebate (the credit to be applied automatically to their electricity bills).

Businesses

- The instant asset write-off threshold of $20,000 for small businesses applying the simplified depreciation rules will be extended for 12 months until 30 June 2025. This measure is currently before the Senate, which has proposed amendments to increase the aggregated turnover threshold to small and medium businesses (with an aggregated turnover of less than $50m), and increase the asset write off threshold to $30,000 for the year ended 30 June 2024.

- Small businesses who meet the relevant eligibility criteria will also benefit from a $325 energy rebate.

Multinationals

- The Labor Government’s 2022–23 Budget measure to deny deductions for payments relating to intangibles held in low or no-tax jurisdictions is being discontinued.

- A new penalty will be introduced from 1 July 2026 for taxpayers who are part of a group with more than $1 billion in annual global turnover that are found to have ‘mischaracterised’ or undervalued royalty payments.

- The foreign resident CGT regime will be strengthened for CGT events commencing on or after 1 July 2025.

Social security

- Social security deeming rates will be frozen at their current levels for a further 12 months until 30 June 2025.

- Eligibility for the higher rate of Jobseeker payment will be extended to single recipients with a partial capacity to work of zero to 14 hours per week.

- The maximum rates of the Commonwealth Rent Assistance will increase by 10% from 20 September 2024.

Superannuation

- Starting from 1 July 2026, employers must pay superannuation at the same time they pay salary and wages to employees. This change will provide employees better visibility and control over their entitlements and assists the Australian Taxation Office (ATO) in recovering unpaid superannuation.

- Superannuation will be paid on Government-funded paid parental leave (PPL) for parents of babies born or adopted on or after 1 July 2025.

- Recalibration of The Fair Entitlements Guarantee Recovery Program to pursue unpaid superannuation entitlements owed by employers.

- There were no new announcements or changes with respect to Division 296 tax ($3m). The proposed new s296-35(1)(a) section of the Income Tax Assessment Act 1997 will likely proceed with no changes. The tax will first apply for the 2025/26 financial year (subject to the Bill making its passage through both houses before 30 June 2024).

- Some key superannuation policy decisions have been taken since the 2023-24 Budget and are not yet law. This includes deduction of adviser fees from superannuation – to increase accessibility and affordability of personal financial advice and access to offenders’ superannuation in certain circumstances.

Tax administration

- The ATO will be given a statutory discretion to not use a taxpayer’s refund to offset old tax debts put on hold prior to 1 January 2017.

- Indexation of the Higher Education Loan Program (and other student loans) debt will be limited to the lower of either the Consumer Price Index or the Wage Price Index, effective from 1 June 2023.

- The ATO will have additional time to notify a taxpayer if it intends to retain a business activity statement refund for further investigation. The current required notification period of 14 days will be extended to 30 days, aligning it with time limits for non-BAS refunds.

- The ATO will receive additional funding to strengthen its ability to detect, prevent and mitigate fraud.

- The Government will provide $17.3 million over four years from 2024-25 (and $3.1 million ongoing) to promote the development of sustainable finance markets in Australia.

GST

- Refunds of indirect tax (including GST, fuel and alcohol taxes) will be extended under the Indirect Tax Concession Scheme.

The full Budget papers are available at budget.gov.au and the Treasury ministers’ media releases are available at ministers.treasury.gov.au