The Coronavirus Economic Response Package (Payments and Benefits) Amendment Rules (No 8) 2020 (the “New Rules”) extend the JobKeeper scheme from 28 September 2020 to 28 March 2021.

Under the New Rules, there are two separate extension periods. For each extension period, an additional “actual decline in turnover test” applies and the rate of the JobKeeper payment is different. This ensures that entities that qualify for JobKeeper payments under the extended scheme have had a recent actual decline in turnover to ensure that it is appropriately targeted.

The extension periods are:

- Extension 1: from 28 September 2020 to 3 January 2021

- Extension 2: from 4 January 2021 to 28 March 2021

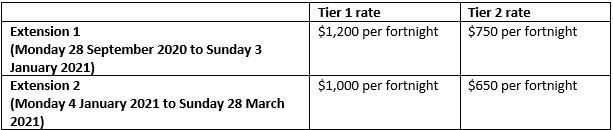

During the first extension period, the higher rate of JobKeeper payment is $1,200 per fortnight and the lower rate is $750 per fortnight. During the second extension period, the higher rate is $1,000 per fortnight and the lower rate is $650 per fortnight. This is a reduction from the previous amount being paid up to 28 September 2020 of $1,500 per fortnight.

Importantly, eligible employers and business participants can enrol for the JobKeeper scheme during the extension period even where they have not previously enrolled, subject to meeting the eligibility criteria (including satisfying the existing requirements such as carrying on a business in Australia on 1 March 2020).

JobKeeper Extension 1

To qualify for JobKeeper payments for fortnights beginning on or after 28 September 2020 and ending on or before 3 January 2021, entities must satisfy the original decline in turnover test (now extended) and an additional “actual decline in turnover test.”

Under this additional test, entities must demonstrate that their actual GST turnover has declined by the required percentage for the quarter ending 30 September 2020 (the months of July, August and September 2020), relative to the entity’s comparable quarter for this period (generally the corresponding quarter ended 30 September 2019).

As per the original JobKeeper rules, the relevant shortfall percentage will depend on the aggregated turnover of the business:

- 30% fall in GST turnover (where the aggregated turnoverof the business is $1 billion or less);

- 50% fall in GST turnover (where the aggregated turnoverof the business is more than $1 billion); or

- 15% fall in GST turnover including donations and gifts (for ACNC-registered charities other than universities and schools).

-

-

-

-

The definition of aggregated turnover remains the same and broadly includes the employer’s annual turnover, plus the annual turnover of all the entities that are connected or affiliated with the employer, subject to specific adjustments (for example, for transactions between the employer and those other entities). These connected entities or affiliates may be based in Australia or overseas.

An entity that can demonstrate a fall in actual GST turnover in the quarter ending 30 September 2020 will also satisfy the original decline in turnover test, meaning that most entities enrolling for the first time will only have to demonstrate that their actual turnover has significantly declined in the previous quarter.

JobKeeper Extension 2

To qualify for JobKeeper payments for fortnights beginning on or after 4 January 2021 and ending on or before 28 March 2021, an entity must have met the original decline in turnover test and also had the required actual decline in turnover for the quarter ending 31 December 2020 (the months of October, November and December 2020) relative to the entity’s comparable quarter for this period (generally the corresponding quarter ended 31 December 2019).

An entity that can demonstrate a fall in actual GST turnover in the quarter ending 31 December 2020 will also satisfy the original decline in turnover test, meaning that most entities enrolling for the first time will only have to demonstrate that their actual turnover has significantly declined in the previous quarter.

An entity may be eligible for JobKeeper Extension 2 even if they were not eligible for JobKeeper Extension 1.

Decline in Turnover Test

In considering the “actual decline in turnover test” for the JobKeeper extension period, entities will no longer be able to rely on a reasonable estimate of their projected GST turnover for a period.

Instead, it is necessary to determine and assess the actual current GST turnover in both the turnover test period (being the September and December 2020 quarters) and the relevant comparison period.

To work out which supplies an entity has made in the turnover test period, an entity must use the accounting basis used for GST reporting purposes.

For many businesses registered for GST, this calculation will match the ‘total sales’ reported at G1 on the BAS minus GST payable (1A), where applicable.

An entity not registered for GST, will work out their turnover using either the GST cash or accruals basis of accounting.

Alternative tests for determining actual decline in turnover may be available in some circumstances. These will apply in a similar way to the alternative tests for the original decline in turnover test. However, they must be applied on the basis that the turnover test period is a quarter (ie there is no option to choose a calendar month). The ATO will publish more information on the alternative tests for the actual decline in turnover test once it is available.

Payment rates

The rate of the JobKeeper payment is different for each extension period.

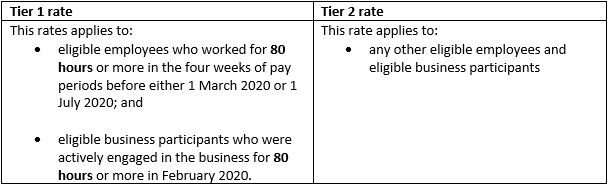

Which payment tier applies?

The rate of the JobKeeper payment in each extension period will depend on the total number of working hours in the applicable “reference period” determined as follows:

For employees who are paid on a different basis (for example, a monthly basis), the 28 day period will only cover a part of the pay cycle. However, other rules ensure that average hours over the pay period are identified on a pro-rated basis.

For example, employees paid on a monthly pay cycle that ends on the 15th of each month the hours worked in the 28 days prior to 1 March 2020 would be calculated as the hours worked in the period 16 January 2020 to 15 February 2020 times 28/31.

Employers and businesses will need to nominate the rate they are claiming for each eligible employee and/or eligible business participant.

Alternative reference period

The Commissioner may determine that an alternative reference period applies where it is considered that the relevant reference period may be not suitable in situations including:

- where an employee worked less hours in the reference period despite generally working on average 80 hours or more over earlier periods so that the hours worked in the reference period were not typical of their established work pattern;

- where employees have taken some form of unpaid leave or unpaid absence during part or all of the reference period making it not representative of their usual work hours in earlier periods (for example, they were receiving parental leave pay, dad or partner pay, workers compensation or emergency service leave during the bushfires);

- were only employed for a part of the reference period (for example, because they commenced employment during the reference period); or

- were not employed at any time during the reference period (for example, an employee who commenced employment after the reference period but is still an eligible employee because they were treated as having been employed on 1 March 2020 or 1 July 2020 because of the change in business rule).

-

-

The Commissioner also has the power to determine, by legislative instrument, methods for identifying if a class of employees qualify for the higher JobKeeper rate where the Commissioner is satisfied that the total hours that count towards the threshold are not readily ascertainable.

This instrument making power available to the Commissioner recognises that employers are more likely to have issues working out the number of hours worked for those employees whose remuneration is not tied to an hourly rate or contracted number of hours. This includes employees who undertake duties principally on a commission, stipend, piece rate or similar basis over the reference period, and their remuneration is not necessarily proportional to their actual hours of work in a particular period.

What doesn’t change

To claim for fortnights in the JobKeeper Extension 1 or 2:

- Entities don’t need to re-enrol for the JobKeeper extension if they are already enrolled for JobKeeper for fortnights before 28 September.

- Entities don’t need to reassess employee eligibility or ask employees to agree to be nominated as their eligible employer if the entity is already claiming for them before 28 September.

What you need to do

From 28 September 2020, entities must attend to all of the following:

- Work out if the tier 1 or tier 2 rate applies to each of their eligible employees and/or eligible business participants.

- Notify the ATO and eligible employees and/or eligible business participants what payment rate applies to them.

- During JobKeeper Extension 1 – ensure eligible employees are paid at least

-

- $1,200 per fortnight for tier 1 employees

-

- $750 per fortnight for tier 2 employees.

- During JobKeeper Extension 2 – ensure eligible employees are paid at least

-

- $1,000 per fortnight for tier 1 employees

-

- $650 per fortnight for tier 2 employees.

- For the JobKeeper fortnights starting 28 September 2020 and 12 October 2020 only, the ATO are allowing employers until 31 October 2020 to meet the wage condition for all employees included in the JobKeeper scheme.

- The ATO have also noted that if entities are registered for GST and have outstanding BAS statements, they should lodge their BAS for the September 2019 and December 2019 quarters as soon as possible (or for equivalent months, if report monthly). Un-lodged BAS statements may hold up the application for payments under the JobKeeper extension.

-

-

For further information and details regarding the JobKeeper extension see https://www.ato.gov.au/General/JobKeeper-Payment/JobKeeper-extension-announcement/

Questions?

If you have any questions, please contact your Blaze Acumen adviser.